Do you think insurance companies deserve a taxpayer bailout? President Obama apparently does. As a reward for insurance companies who participated in the failed Obamacare marketplace, the Obama Administration is now looking to cushion their losses with your tax dollars.

When drafting Obamacare, President Obama knew the individual marketplace would be inherently unstable. Instead of letting free markets work, Democrats decided to solve the problem with more big government programs.

One of these was the “risk corridors” program. Insurance companies which made a profit would pay a government-mandated fee to compensate insurance companies which lost money on Obamacare. You can guess what happened based on all the negative headlines. Too many companies lost money on Obamacare and fees fell well short of reimbursement requests.

Sensing that President Obama would try to use your tax dollars to make up the difference, I twice joined my colleagues to pass legislation ensuring no taxpayer dollars could be used as an insurance bailout. President Obama twice signed this into law.

Now, with insurance companies suing the federal government seeking full reimbursement, the Department of Health and Human Services has signaled its intent to settle these lawsuits in a way that would amount to a backdoor, taxpayer funded insurance bailout.

In response, I recently wrote a letter reminding the Obama Administration of the law and emphasizing the full commitment of Congress to stop any potential backdoor taxpayer bailout for insurance companies that lost money through Obamacare. My letter was co-signed by 45 colleagues, including 3 Committee Chairs and 22 Subcommittee Chairs.

“Any attempt to settle these cases out of court as a backdoor way to direct taxpayer dollars to insurance companies through the Judgment Fund will be met with the strictest scrutiny from Congress … We remain committed to exhausting all legislative and judicial options to ensure the power of the purse vested in Congress under the Constitution is respected and maintained,” my letter states.

Following our letter, lawyers at the Department of Justice surprised observers by filing a motion to dismiss two of the risk corridor lawsuits, arguing Congress did not intend for the Department of Health and Human Services to become “the uncapped insurer of the insurance industry itself.”

This is an encouraging step. Still, many other lawsuits remain, and Congress must continue to conduct proper oversight to ensure no taxpayer dollars are used for government bailouts.

Reviewing foreign investments

Should a Chinese, state-controlled firm be allowed to purchase critical infrastructure in the United States? Does a foreign investment increase the risk of cyber war or job loss through currency manipulation? These weren’t issues in 1975. Unfortunately, the Committee on Foreign Investment in the United States, which is responsible for reviewing national security implications of foreign takeovers of U.S. businesses, has not been substantially updated since being created under President Ford.

Due to the evolving nature of national security threats, I requested the Government Accountability Office review whether CFIUS statutory or administrative authorities have kept pace. This week, the GAO officially accepted my request and will begin their review in early 2017. My bipartisan request is supported by House Intelligence Committee Chairman Devin Nunes and was co-signed by 15 additional Congressional leaders.

Support for veterans

The most recent Inspector General report on wait times at the Salisbury VA was replete with a lack of accountability and the self-serving interests of employees. We must restore accountability and transparency at the VA, which is why last month I helped pass legislation making it easier for VA employees to be fired for poor performance.

If you are a local veteran who needs assistance cutting through VA red tape, please call my office at 704-362-1060. We thank you for your service, and would be honored to serve you.

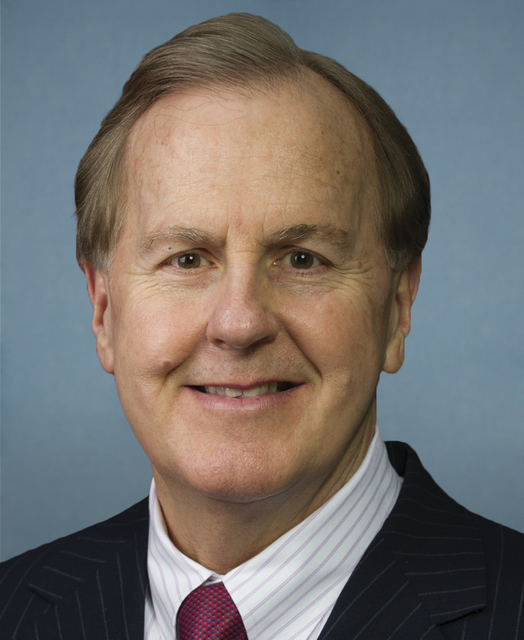

Congressman Robert Pittenger (NC-09) is Chairman of the Congressional Task Force on Terrorism and Unconventional Warfare, Vice Chairman of the Financial Services Task Force to Investigate Terrorism Financing, and serves on the House Financial Services Committee, with a special focus on supporting small businesses, community banks, and credit unions.